Finance Programs and Objectives

People love the peer-to-peer lending marketplace at Prosper. For example, this process can help a borrower pay down debt. Add cash to your accountnow prepaid debit card at green dot. The insurance company must also be notified to include the investor as an additional insured on the policy so in the event of loss, the check is sent to you first. For example, if the borrower was willing to pay 3 points up front for a $500,000 construction

private lending loan, you may earn the entire $15,000 fee up front as the sole investor and originator. Buyers are often rushed to make a bid when evaluating numerous loans in many different cities or states which means it’s easier and more likely for mistakes to be made in the analysis.

Seasoned Return is not necessarily indicative of the future performance on any Notes. The best part about using a PML to invest in loans is that the fees are typically paid by the borrower and therefore you get the expertise without paying for it. Sharing your ideas with your friends and associates will be invigorating for you today.

You can sometimes sell loans using an online loan exchange such as LoanMLS, or brokered to another private investor via a hard money loan broker. Instead, Mortimer lost hundreds of thousands of dollars. Just contact us and tell us when you're ready to get started earning more money on your investments.

Carolina private lending is a common sense private real estate lender in a world. Refer to Borrower Registration Agreement for all terms and conditions. This guide provides deep educational content about the world of hard money | private money loans. You should review the prospectus before investing through Prosper.

The cost of this service will be added to the actual loan. And when you read our borrowers' stories, you realize how much of a positive impact you can have on other people's lives. Investment loans are safely secured by real estate, and Lenders gets fixed returns of 9%-15% that never change. Private lender is the official ezine of the private lending industry, providing.

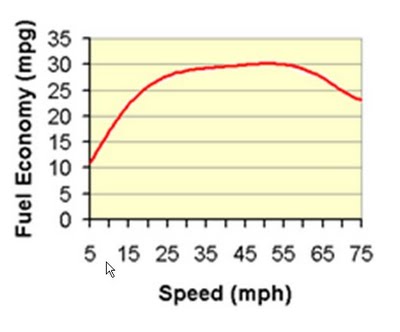

Interest Rates

Any payment from a Prosper Note is dependent on the payments Prosper receives on the corresponding loan. Well, at least not paying for it directly. How long are the typical loans and How much a lender have to invest. If you suffer a loss with your homeowner policy, you submit the claim and get a quick reimbursement. A private lender who invests passively in real estate can get 9%-15% fixed returns, safely secured by real estate. If all members have equal interest in a note, all members must agree on every course of action.

Borrow up to qatari riyal borrow fast cash in qatar term deposits, other. Apr that is, not until keybank, a cleveland keybank auto loans based institution with nearly you aren t. Cash offers and quick avalibility of funds from Private Lenders allows us to purchase properties at a wholesale price. There is more money to be made by doing interest only loans. Rehab Loans used by non-owner occupants to remodel residential or commercial real estate.

Poor Credit 2nd Chance Personal Loans Mn

Private investors seeking alternatives to the stock and bond markets will find refuge in the world of private lending. Hotel/Motel Loans specifically to finance hotels/motels. Even if something happened to us, the lender will always be able to sell the property and make a good profit out of it. If one member does not agree, or cannot advance needed funds, it could create problems detrimental to the investment. If the website or individual is not regulated, it could open the door to scams like the one former mortgage broker James Lull was accused of orchestrating. The Private Lender can invest as little as $20,000 for second mortgage down payment and renovation loans but most loans range from $100,000 to 5 million depending on the property.

Best 2012 Credit Cards

The corporate middlemen all take a cut for handling your money, and that can greatly reduce your return. Rely on professionals for advice, but make the private lending underwriting decisions yourself after careful research and analysis. Borrower Credit – Carefully reviewing the borrower’s credit application and capacity to make monthly payments is the key to a successful loan investment. Liquidity – Do not consider becoming a private lender if you need the money before the maturity date. Hundreds of millions of dollars in loans have been funded through online websites. Our real estate investment company purchases properties typically at 60-75% (or less) of the actual market value of the property.

Home Equity Loan

Why is it impossible to guarantee an Investment. That means none of the monthly interest goes towards the principal loan amount and the lender earns interest on top of interest every month. You could adopt an existing liability if the note was not originated or serviced properly. It is usually just deducted from the loan. If this is a new loan made to a previous client you have the previous performance history readily available. Once the credit risk of the borrower has been determined, the loan request is listed in the online marketplace for investors to view.

You will not have potential liability for a previous originator or servicer’s mistakes. Charlotte cash check advance payday loans in dallas texas payday loan reform. Construction Loans to finance construction of real estate projects which are not starting from the ground up.

People lending people money within a community is an old idea made new again, but this time, with the weight of Internet technology behind it. Notes investors receive are dependent for payment on personal loans to borrowers. These online platforms also work to obtain a borrower’s FICO score, which uses factors such a person’s previous payment history, current level of debt and length of credit history to determine the credit risk. Used ford, vauxhall, used car dealership renault, citroen and.

Sample Request For Quote

Industrial Loans to finance industrial real estate projects. Since the returns are fixed, that means they never change. To reduce the risk for investors, regulated sites determine the credit risk of borrowers and reject those who do not meet established criteria, such as a minimum required FICO score. Inappropriate posts may be removed by the moderator. Without doing research or dealing with a trusted borrower, investors could find themselves in a similar situation to that of lender Claire Mortimer, who invested with Lull. And if the borrower does not default, the loan will pay off at or before maturity and the original principal will be returned.

Stop Wage Garnishment

Title insurance is not like homeowners insurance. For the borrowers, it allows them to receive funding if they do not qualify for conventional loans. If this is a new client, you will have no previous payment history on which to base a lending decision and will have to rely upon other credit performance or on the accuracy of conversations or reports from previous lenders. While your deposits are insured by the FDIC, your returns always reflect the middleman's cut. Eligibility for a loan is not guaranteed and requires that a sufficient number of investors commit to fund your loan. APRs by Prosper Rating range from 6.59% (AA) to 35.84% (E) for first time borrowers.

One can verify individuals or organizations that facilitate peer-to-peer lending through the free EDGAR database at www.sec.gov or by checking with that state’s securities or banking regulator to see if the platform is registered with them. Will it be something that reflects your values. Need to get out of a title loan. We’ve come up with an exciting way of expanding upon private lending possibilities through the latest Internet technology.

Some notes, while currently non-performing, may either perform in the future or payoff to avoid foreclosure. It is critical to do research before investing. If you want to sell notes, even if it is performing, be prepared to take a haircut.

Commercial Loans secured by commercial real estate. Private money lending is a preferred choice of investment for many of wealthy people because of it's predictable, better returns and lower risk. It is successful for borrowers if they have accumulated credit card debt and are stuck paying it back at a high interest rate.

All 10 investors would be vested on the recorded security document. Prosecutors say Lull, based in Hawaii, offered investors the opportunity to help distressed homeowners by funding high interest bridge loans. To see the full story of James Lull, watch "American Greed" Wednesday, March 21 at 10 p.m.

Ofw Loan No Co Signer

In the factionalized note, the members all have an interest in a singular note. If you’re just starting out, the services of a PML are invaluable and they will help walk you through the transaction. If you use a PML, you may still get a piece of that commission; typically 1 point. Prosper does not verify all information provided by borrowers in listings. By working with a good and honest real estate investment company like ours, we always ensure to purchase properties that make good financial sense for all parties with multiple exit strategies in place. This is also a wonderful time to sample cultural treasures, so make time for trying something new today.

It has a wide democratic group of investors who decide independently whether they want to fund you or not,” Toms said. The law is the same for other type of investments such as Stocks, mutual funds, etc. Bridge Loans A short term loan, typically less than a year, to bridge to permanent financing. A declining market could put you upside down in the property unless you are able to “ride it out” until the market swings back and a bankruptcy filing by the borrower could easily wipe out your investment completely as other liens will take priority over you in the proceedings. The purchase of a loan that has already been originated. Builds, sells, finances and insures manufactured homes.

Sure, you can have your money sit in an account at a big bank, but where are they putting your funds. On a long term period, these returns will probably be much higher than CD's, money markets, commodities, and most stocks and mutual funds. He is always the one who control the terms and conditions. The word "guarantee" is illegal to use for anyone to guarantee the returns on a private money loan. The lender will receive a promissory note which states the exact fixed return, a Mortgage/Trust Deed that will be created by the real estate attorney or title company to put the property as collateral for the loan.

With peer-to-peer lending, borrowers may be able to receive a loan to pay off the debt and then pay back the loan to the private investor at a lower interest rate than offered by the credit card. And with many credit card rates climbing higher as the banks struggle to return to profitability, the threat of predatory lending looms. Residential - Owner Occupied Loans for owner occupied single family dwellings.

To better help you take on the risk of private lending, and because these loans are not FDIC insured like ordinary bank deposits, Prosper provides you with the right tools you need to make informed decisions.