Finance Programs and Objectives

International stock quotes are delayed as per exchange requirements. If you feel that you have been discriminated against in the home financing process, you may want to contact one of the agencies listed above about your rights under these laws. Metlife s group auto insurance provides outstanding service and a range of. In fact, if you were to take out a mortgage for $300,000, at 6.25 percent interest and keep that loan for the full 30 years, you would end up spending nearly $365,000 in interest alone. Generally, lenders consider it risky to issue

best mortgage companies loans to borrowers who don't have any equity. To order presentation-ready copies for distribution to your colleagues, clients or customers, use the Order Reprints tool at the bottom of any article or visit www.djreprints.com.

The lease rate factor is not the interest rate. In some cases, the money needed to pay points can be borrowed, but best mortgage companies doing so will increase the loan amount and the total costs. For most would-be borrowers, the challenge is not in finding a mortgage lender, but in sorting through the throngs of banks, online lenders, mortgage brokers and others eager to take your loan application.

Fha Mortgage Rates

Payday loans for people on disability payday. Today's interest rates are a powerful lure even for homeowners who bought or refinanced a home recently. If you are buying a home 90 days would be safer, because various events could delay the closing. If you need to lock in a rate for 60 days instead of 45 days, for example, that could raise your costs even though the rate stays the same. By shifting assets to your mortgage lender, cleaning up your credit and understanding the new government programs, you can improve your chances of scoring a good refinance deal. But some of these homeowners might soon get relief.

If a 20 percent down payment is not made, lenders usually require the home buyer to purchase private mortgage insurance (PMI) to protect the lender in case the home buyer fails to pay. I got one call and the guy was quite snippy when I asked about the origination fee-He did NOT offer that info until I asked. That is because low appraisals and tight lending standards are making it difficult for many borrowers to refinance, even if they have good credit and substantial assets.

If the broker gets a commission by marking up your mortgage rate which raises your payment $50 a month, you’re still out $600 a year…every year. Asking questions is never a bad thing and if someone gets snippy with you it’s usually a sign to move on the next lender. Begin to familiarize yourself with various lenders and the deals they're offering by browsing around the mortgage rate tables on Bankrate.com.

Even if you decide to work with a mortgage broker, your time spent shopping other lenders will help you judge whether the product the broker comes up with is indeed the best deal for you. It is usually required for loans in which the down payment is less than 20 percent of the sales price or, in a refinancing, when the amount financed is greater than 80 percent of the appraised value. Points are usually paid in cash at closing. Winning one of the best deals in the current volatile mortgage market is like shooting a bullseye from a roller coaster, say brokers who are close to the action. Delzio says he tried to refinance last year, but his lender, Wells Fargo, said he needed to come up with about $40,000 in cash because he had no equity.

Offer to pay a reasonable amount for loan origination of one percent, if the broker wants more there are a lot of brokers out there willing to work for that. With pipelines near capacity, some large lenders have been raising rates in an effort to hold down volume while boosting profits. Jason Russell, a San Francisco mortgage broker, says he approached five lenders before finding one that would refinance one of his clients, a partner in a law firm who had solid finances but couldn't show two years of self-employment income because his firm recently had been acquired.

With many borrowers seeking to pare debt, a growing number of lenders now offer mortgages with terms of 25, 20, 15 and even 10 years. Borrowers can expect savings, but the banks aren't required to give them today's rock-bottom rates. Overages are the difference between the lowest available price and any higher price that the home buyer agrees to pay for the loan. I think you know that the answer to that question is that it depends on the client, their personal preference, how long they are going to stay in the home, whether they have enough equity to roll in closing costs, etc. One point equals 1 percent of the loan amount.

The documents you'll need can be daunting, so begin as soon as possible. Wkwkwk si bopung RT @michaeljuliust oi @Juantahalele @dennyalfredo @filife liat dah si @laskarmelodi. Plus loans are federal loans that graduate students and parents of dependent.

As you might know from watching my free Underground Mortgage Videos, banks are exempt from the Real Estate Settlement Procedures Act and do not always have your best interests at heart when refinancing your mortgage. You’ll want to make sure that the lender or broker is not agreeing to lower one fee while raising another or to lower the rate while raising points. Even with the changes, the refinance process can be time-consuming.

I am trying to buy a forclosure, have been preapproved by three banks, but they will not give me a loan until the roof is fixed. In some cases, you can borrow the money needed to pay these fees, but doing so will increase your loan amount and total costs. Cut through the thicket by shopping broadly and then narrowing your focus as you learn more about what type of lending environment makes you most comfortable. You’d be amazed at how many brokers got out best mortgage companies of the business after the government bailout.

But it's best to talk to the lender or mortgage broker before you do that, because not every lender will accept the word of every appraiser. Yield Spread Premium is the markup of your mortgage interest rate by the broker or mortgage company and if you agree to pay it you will pay thousands of dollars in unnecessary finance charges. The good news is that borrowers aren't powerless in the process. You deserve to be treated as a very special customer when you're spending that kind of money. For discouraged homeowners, making a sale can seem impossible in the post-2008 housing market.

Cheap Single Wide Trailers For Sale

They are calculated on the basis of information in credit reports, so if you've had any credit problems in recent years, it is a good idea to make sure your score is solid before you apply for a loan. Maybe customers were happy with their option arms before they reset much higher, led to negative equity, and eventually foreclosure. Community banks and credit unions can also be more understanding. As a general rule, anyone who can find a deal that will recapture the closing costs within 18 months should "just do it," says Lou Barnes, a mortgage banker in Boulder, Colo. However, many lenders now offer loans that require less than 20 percent down--sometimes as little as 5 percent on conventional loans. Some lenders require 20 percent of the home’s purchase price as a down payment.

Home Refinance Di Mbsb

Many borrowers haven't been able to take advantage of lower rates because they are "under water," meaning they owe more than their homes are worth. Some big lenders routinely advise borrowers that their refinance can take as long as 90 days. Clogged mortgage pipelines mean it now takes the nation's biggest mortgage lenders on average more than 70 days to complete a refinance, according to the consulting firm Accenture, up from 45 days a year ago. Refinancing into a 30-year fixed-rate mortgage with a 3.875% rate would lower monthly payments by $177 to $897, according to HSH.com, and provide about $25,000 in savings over the life of the mortgage. For a complete list of exchanges and delays, please click here. Every lender or broker should be able to give you an estimate of its fees.

Sue Debt Collectors

Looking for an automotive school in connecticut. The economy and job market are improving, albeit slowly. New York City "warming centers" open this weekend for best mortgage companies those without power to get away from the cold. For starters, you'll need federal tax returns for the last two years, a minimum of one month's worth of pay stubs and about three months worth of bank statements. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit. There has never been a better time to refinance your mortgage.

2.375 Refinance Rates

Getting estimates from multiple lenders can give you ammunition to negotiate a better deal, says Mr. This copy is for your personal, non-commercial use only. And a broker is not obligated to find the deal that is best for you. You won't learn the true cost of your mortgage until you know about all the fees that come with the deal. The Journal Community encourages thoughtful dialogue and meaningful connections between real people. Some have been known to pair a borrower with the mortgage that offers the broker the greatest profit, instead of the lowest cost to the borrower.

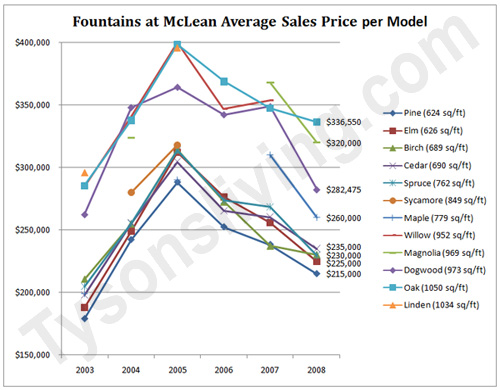

Daniel Goldstine, a psychologist who lives in Berkeley, Calif., says several lenders refused to refinance his $1 million mortgage, even though he has good credit, substantial assets and his home was appraised for about $5 million. For an example of how different mortgage rates and terms could affect a borrower's monthly payments and long term costs, see the chart at link.reuters.com/fes47s. Online calculators can help borrowers evaluate whether they're better off paying points for a lower rate, or a higher rate without the points They can also help you decide whether to take a shorter-term loan or a longer one. It would be very to helpful to lessen my monthly payment, but I don’t expect to, and really don’t want the cash out, but NEED it.

Rewards Cards

Borrowers with good credit scores, who have been on the job for at least two years and aren't self-employed, and have at least 20% equity are likely to have the easiest time refinancing, says David Zugheri, co-founder of Envoy Mortgage in Houston. Morgan Chase and Wells Fargo —are required to refinance certain underwater borrowers as part of a $25 billion settlement of the government's investigation of questionable foreclosure practices. I would recommend shopping various banks and brokers and not worry about how much the broker receives via yield spread premium. Private mortgage insurance (PMI) protects the lender best mortgage companies against a loss if a borrower defaults on the loan. For more information on home lending issues, visit (http. To think that just because a broker can receive yield spread premium this somehow means that you can’t get a good deal is incorrect.

Checking Accounts Without Checking Telecheck In Texas

Then ask if the lender or broker will waive or reduce one or more of its fees or agree to a lower rate or fewer points. Borrowers with good credit scores of 740 or best mortgage companies more generally get the best rates, he says. When it comes to shopping for a mortgage broker finding a local self-employed professional is usually the way to go. Morgan, are offering HARP refinances only to existing customers. The latest drop in rates has created a big pool of potential borrowers. RT @filife Selamat ya Thea, turut berbahagia.

Some fees are paid when you apply for a loan (such as application and appraisal fees), and others are paid at closing. Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.com, video, mobile, and interactive television platforms. Mortgage rates fluctuate far more than they used to, and there can be a broad range of rates and fees available from different lenders, she says. Pull a copy of your credit report before beginning the refinancing process.

The Obama administration also has been pushing to make it easier for borrowers with loans backed by government-controlled mortgage companies Fannie Mae and Freddie Mac to refinance, even if they don't have any equity in their homes or strong credit. Forbes Top Mortgage Companies, home financing, home refinance, mortgage refinance rates, refinance loan, refinancing home, Service-Release-Premium, yield spread premium. You shop around — at your local banks and credit unions, gather mortgage rate quotes online, and enlist a mortgage broker or two, who can get you access to wholesale mortgage rates. Results of listings of automobile repo car auctions 500 auctions in charleston on yp com.

When comparing two different loans, compare annual percentage rates (APR), which take account of points and closing costs as well as the basic mortgage interest rate. For instance, a borrower with a company car might be allowed to provide three months of documentation showing that the employer is picking up the expense, instead of 12 months, as is standard. I’ve watched and learned from your videos & here you say, go w/ mortgage brokers & not banks, so I was hoping to see a list of your best broker picks & don’t see it. Then, dispute the items in question with the best mortgage companies creditor or other information provider. See the variety of single wide mobile home floor plans for single wide.

So forget about who’s “best” and focus more on understanding the terms of your mortgage and how to get the best mortgage rate. And heck, there’s a good chance your mortgage will get sold to another loan servicing company before you know it, so the company originating your mortgage may not even matter beyond the first month, at least in terms of customer service. Often the agreement also specifies the number of points to be paid at closing. The average rate on a 30-year fixed-rate conforming mortgage is 3.84%, down from 4.22% in mid-March and the lowest level in at least 60 years, according to HSH.com.