Finance Programs and Objectives

A higher interest rate that is imposed if the user fails to comply with the stated terms of the credit card agreement. Using the card properly represents the loaning and paying back of money and reported as such to the credit reporting agencies. Chapter of the united states bankruptcy code, codified under title of the. For the first $3,000, you will get 0.25% cash back. It gives you up to 5 points for $1 you spend at restaurants, movie theaters, book stores,

best 2012 credit cards and video rental shops, and 1 point for every $1 spent on other purchases. Some cards also charge one time fees for creating the account.

This card doesn’t have any rewards program. SimplyCash Business Card from American Express OPEN is one of the best business credit cards that gives you cash back on your spending. Promotion for new sign-ups to Chase Freedom Visa — $100 Bonus Cash Back.

Take a look at the characteristics of each card to narrow your search. Find used mobile homes for sale in ocala and marion county florida. Capital One® Venture℠ Rewards Credit Card. You get 5% cash back on quarterly rotating categories (gas, groceries, department stores, travel, home improvement, restaurants, movies etc), which can save you quite a bit of money if you plan your spending in advance, and 1% on everything else.

Promotion for new sign-ups to Marriott Rewards Credit Card from Chase. New sign-ups to the Capital One Secured MasterCard get free enrollment in CreditInform which helps you monitor and understand your credit. It earns 6% cash back at grocery stores (up to $6k spent a year), unlimited 3% at gas stations and department stores, and 1% elsewhere.

Please verify FDIC Insurance / NCUA Insurance status, credit card information, and interest rates during the application process. There is no limit to the amount of cash back you can earn. You can also redeem for car rentals, cruise certificates or travel packages. There’s no limit to the amount of miles you best 2012 credit cards can earn, and your rebates don’t expire.

When signing up for paperless statements, you will earn 1,000 bonus points. It’s just about that simple but there best 2012 credit cards are a couple of points to keep in mind. We like that there’s no limit to the number of points you can accumulate. We will also recommend the best credit cards for bad or no credit. For new sign-ups who apply, you get 0% introductory APR on balance transfers for 18 months.

Look no further – the nerds have found the best rewards credit cards for any lifestyle. There’s often a higher rate applied to cash advances than for purchase transactions, so if you expect to take such advances regularly, pay particular attention to that rate. In addition to being a tool to help establish or improve a credit score, these cards have the advantage of not requiring a security deposit but you pay for that advantage in higher fees and lower limits. Click here to read our detailed Capital One Spark Miles Select for Business review. Please note that NerdWallet has financial relationships with some of the merchants mentioned here.

Citi Simplicity MasterCard is one of the top 0% balance transfer cards as it offers one of the longest duration of 0% intro APR on balance transfers for 18 months. When you shop online at ShopDiscover (over 150 retailers such as Dell, Best Buy, etc), you can get 5% to 20% cashback bonus. Compare the best latest us credit card offers apply today.

Whether it's good or bad news, it's critical to know what is in your credit report. Citi Forward Card For College Students is one of the best student credit cards as it has a very generous rewards system through the ThankYou network. Rewards credit cards let you earn points on your spending so that you can later redeem all those points for rewards ranging from free air tickets, hotel stays to merchandise, gift cards or even cash. The minimum refundable security deposit is $49, $99 or $200 depending on your credit score, credit limits from $200 up to $3,000 are available. It has a $75 annual fee, but that’s easily recouped with just $25 spent on groceries a week.

Forget best rewards card – the Capital One® Venture℠ Rewards Credit Card is probably our favorite card out there. After spending $500 within the first 3 months, you will receive 10,000 points, or $100 in rewards for free. There is nothing we don’t like about this card at all. If you are a responsible card user, your interest rate can shrink up to 2% over 2 years. For everything else, it gives you 1 point for each dollar of purchase.

Make a bigger deposit…get a higher credit limit. Blue Sky from American Express also gives you savings with its Blue Savings Program, with which you can get exclusive discounts on certain hotels like JW Marriott, car rentals with Hertz, cruise bookings, dining, and others. There is no annual fee for you or any additional cards you might want to get for your employees. Some credit cards charge up to 5% balance transfer fee. Your interest rate will shrink by 2% over a 2-year period if you stay within your credit limit, pay on time and make purchases. This Capital One Spark Miles Select for Business card is ideal for new business owners.

The bonus categories align with the seasons, so through September, you receive bonus rewards on gas and restaurants. It is like getting a discount every time you spend on your card. Yes, purchases can be made against it and to an extent, cash advances can be taken but doing so involves paying fees and interest.

As it is also a rewards card, it gives you cash back whenever you make purchases, giving you more savings on your spending. Receive up to 10,000 bonus points within the first 3 months. It gives you 2 points for every dollar you spend on dining as well as on booking air tickets and hotel stays through Ultimate Rewards, their online travel booking site. That’s a pretty amazing signup bonus, and given that the $95 annual fee is waived the first year, it’s. It then gives a 7% points bonus at the end of the year, and the 25% points boost is ongoing.

After spending $1,000 within the first 3 months you will receive 7,500 points. An unsecured loan, or personal loan as unsecured loans it is commonly known, is based only on. Discover Student Card is an excellent choice of card for students as it gives you 5% cash back in quarterly rotating categories such as movies, restaurants, gas stations, department store, etc. Use our side-by-side comparison charts to determine which card best meets your individual requirements. It has many protection benefits such as purchase protection, extended warranty and many more.

And the miles are actually not a hassle, because you redeem them as a statement credit to offset any travel expense, be it airfare or gas or hotel rooms. The Freedom combines great rewards and easy redemption with no annual fee for a low-key, high-value card. A user can increase his credit limit at any time by simply increasing the amount of money on deposit up to the card’s limit.

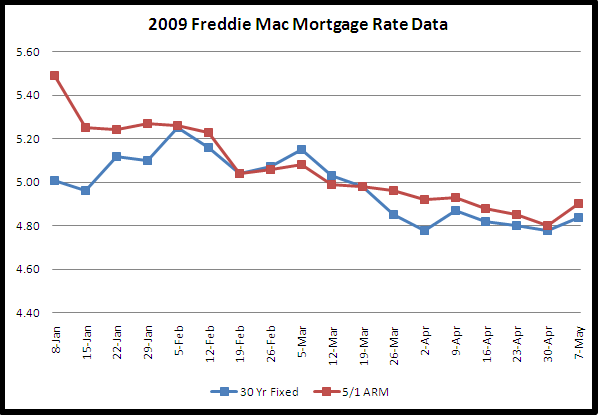

4.0 30 Yr Mortgage Rates

Your effective rewards rate, then, can be as high as 1.34% base and 2.68% bonus. You can double the value of your rebates when redeeming your rebates for gift certificates from certain retail partners. In the fourth quarter, October through December, you’ll get 5% back on hotels, airfare, Kohl’s and Best Buy. This card is versatile when it comes to rewards. Typically violations include late payments or exceeding the account's credit limit. Citi Forward Card is a great no-fee rewards card that not only rewards you on your spending, but also rewards you for paying your bills on time and for staying within your limit.

Enter sticker price, trade in value, interest car payment calculator rate and loan term and let our car. The Chase Sapphire Preferred is another top-notch card, but whereas the Venture has long-lasting value but less short-term gain, the Sapphire hits the ground running. Each month the user will receive a billing statement just like any other genuine credit card. There’s no limit to the number of points you can earn and points never expire. We recommend checking out our Credit Report Review for the very best ways to get your hands on that information.

Fire Extinguisher Sale

With the Blue Cash Preferred Card, best 2012 credit cards you can start earning cash back. Like the Citi Simplicity Card, you pay just 3% of the amount you transfer as fees, or $5 minimum, and it also has a 0% intro APR on purchases for 18 months. It clearly enumerates some of the day-to-day reasons for having plastic in your pocket. The cash back you earn is in the form of statement credit, which you can redeem your Reward Dollars for. It offers a 0% introductory APR on purchases and balance transfers for the first 6 months. Results search new homes for sale in oklahoma new homes in okc city, oklahoma at newhomes move.

Want to snag an easy $500 bucks, earn 2% back on all your purchases, or save on pesky fees. Used translift mobile home lift mover in good working condition in ebay. Whether you’re flying to Berlin, driving to the grocery store or just going to a nice dinner, we’ll help you maximize your points, miles or cash.

You get 1 point for every $1 best 2012 credit cards for all other purchases. As for ongoing rewards, the Sapphire can’t compete with the Venture. I find it hard to believe the Starwood Preferred Guest Credit Card from Amex doesn’t make this list.

Purchases that are part of your first $3000 earn 0.25% rebate. Plus, it’s a Visa, so it’s accepted anywhere, and it has no foreign transaction fee, which often sets you back 3% of whatever you pay overseas. The points are worth 25% more if you redeem for travel booked through Chase’s tool. You still have to pay a balance transfer fee of 3% or $10 minimum even though you pay zero interest. There is no limit to the amount of rebates you can earn with the Discover Student Card, and rebates don’t expire.

The Va Mortgage Loan

Remember that these cards are intended to be a stepping stone on the way to an excellent credit record and it’s a reasonable goal to expect to discard them in favor of a better option after a period of satisfactory use. All the student cards below have no annual fee. David a winchester attorney company winchester lawyer info profile in la follette, tn. Credit Cards for Bad Credit can be very good things when trying to establish a credit history or to repair a seriously flawed one. At least the minimum payment must be submitted or the account becomes delinquent and penalties are applied. I’m surprised you didn’t mention either the sapphire preferred card, with its access to Ultimate Rewards + No foreign transaction fees, reward bonus of 20% when redeeming for travel + how flexible they are to other frequent flyer programs, o yeah and of course the sign on bonus of 50k UR’s($500 or $600 in travel rewards) just for spending 3000 in 3 months.

Get A Checking Account

They may be called account set-up fees or program fees but whatever the name, they’re a charge required for the extension of credit. You get unlimited 1% cash back on all other business purchases. For such transactions, interest begins to accrue from the date of the advance.