Finance Programs and Objectives

National Debt Relief offers friendly, knowledgeable and responsive debt counselors to assist throughout the process. Now, should you choose to enroll in a debt relief program – neither debt management or debt settlement has as serious impact on your credit as a bankruptcy – but both will have an impact on your credit. Citibank s certificate of deposit cd compare current cd rates interest rates are guaranteed and. TopConsumerReviews.com, LLC is a leading provider of independent reviews and rankings for thousands of consumer products and services. Although he was very friendly during the appointment,

pennsylvania debt relief he was not very forth-coming. Meanwhile, you’ll see your annual interest rates reduced by a substantial margin.

Now the true horror sets in and your mind begins to spin. We very well may be the fastest growing law firm in the state of Pennsylvania. While debt consolidation may be a smart move for many consumers, it is certainly not the only option.

Use this calculator to help you figure car lease calculator if your best deal is to buy or. CuraDebt has been business since 1996 and provides financial assistance including debt consolidation, debt management, and consumer counseling. But regardless of the system you follow – the first step in a successful do-it-yourself debt relief program is to do everything possible to live within your means – avoiding unnecessary "impulse" purchases that cause debts to spiral out-of-control. If you have high-interest credit cards and other debts and are struggling to make ends meet – you are in need of debt relief. Since bankruptcy, I now tithe, which is something I did not do prior.

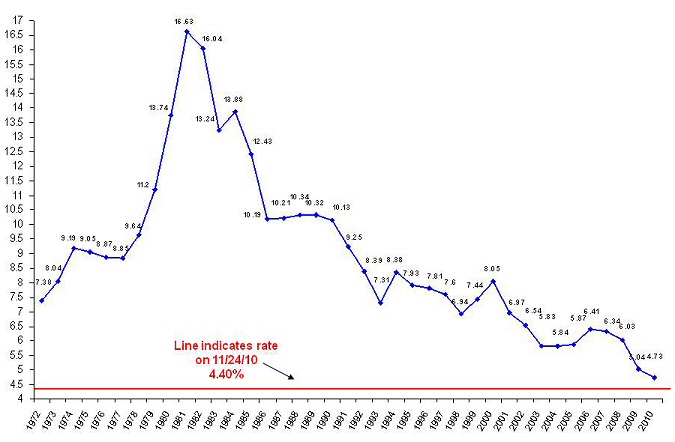

30 Year Commercial Loan Rates

TopConsumerReviews.com has carefully reviewed several of the nation's leading debt relief companies to determine who ranks among the best for residents of Pennsylvania. The counselor remains with each client from start to finish. The Lord has blessed me with a mission of serving others through my Full-Service Debt Law Firm. That doesn’t make you bad, it just makes you unfortunate. When you enroll in a program of Pennsylvania debt settlement, you’ll immediately begin saving for a lump-sum payment that could reduce your debt burden once and for all. They work with Pennsylvania residents pennsylvania debt relief with $7500 or more of unsecured debt.

Depending on your debt situation, debt consolidation may help you not only reduce your debts but also give you guidance on managing your finances. Over the years, we've talked to many people who often felt extremely frustrated, or hopeless, or like the credit card companies took advantage of them and caused them to get into debt. However, rules enacted in 2005 now requires those filing Chapter 7 to pass a "means test" – to qualify, they must earn equal to or less than the average monthly income for a family of their size in their state. While bankruptcy plays a vital role to help rescue individuals and businesses, it is important to recognize that it's not the only debt relief option. Your debt speitt can provide more details regarding debt consolidation or debt management as part of your free debt relief analysis and savings estimate.

When you take out a consolidation loan in Pennsylvania, your lender will immediately pay off your existing loans and refinance your debt load into one massive credit vehicle. Applying for our fast unsecured loans is astonishingly easy and in most cases. Following a review by the credit counselor of your obligations and overall ability to pay off your debts, the counselor will - on your behalf - propose to your creditors an offer which could result in a reduction of interest rates, or removal of late fees and penalties. The fact is, particularly in these tough economic times, the faces of debt represent all of us – it's the family struggling to make ends meet, the single mom or dad often forced to rely on credit cards to pay for the necessities of life – it's the successful entrepreneur or business owner who going through a rough spot trying to manage the business -- it's even everyday people who get caught in the credit card trap – the plastic promise of buy now, pay later.

Based on this information, your debt speitt will then customize a "debt management plan" for you. If you’re struggling with unsecured debts like credit card bills and business pennsylvania debt relief loans, you should seek help from a trustworthy Pennsylvania debt relief provider. By creating and maintaining a realistic budget, you will avoid taking on additional debt. Likewise, most debt consolidation lenders don’t extend credit to folks with poor credit scores.

They are experts in creditor negotiations, arbitration and settlement services for individuals and small businesses located in Pennsylvania. How would it look for an attorney to file bankruptcy. He explained even less than the first attorney, but his fee was much less. These days, both debt consolidation and debt settlement are widely used alternatives to bankruptcy - which can negatively impact your credit rating in a more damaging way and for a longer period of time.

I needed to go through this so other people would not have to share my pain and frustration. Free advice on your rights debt collection companies what to do when they call. Keep in mind, however, the potential risks involved.

NO Overseas Installment Loana

The ranking is determined by key factors such as company history, professionalism, customer service and fees. To find out more about debt relief companies, including reviews and comparison rankings, please visit the Debt Relief Programs category of TopConsumerReviews.com at http. Practically everything you own is going to be sold at a Sheriffs' Sale. While "debt consolidation" is a term that's often used as a "catch-all" for the many forms of debt relief available, what it involves is combining credit card and unsecured debts into ONE, easier-to-manage, and more structured payment plan made to a credit counseling agency. It turns out the gentleman I spoke with knew about as much as I did, at that time. TopConsumerReviews.com provides independent reviews for thousands of products, including debt relief programs, in order to help consumers make better informed decisions.

As a form of debt relief, debt settlement allows you to negotiate with credit card companies at a significantly reduced amount than what you currently owe. Shortly after meeting him, an acquaintance mentioned another attorney. They offer the latest on debt relief programs including information, education, and ratings for the best debt relief companies available today. Owner financing mckinney texas, for no credit check homes mckinney rent home fireplace garage pool. For 35 to 44 year olds, the number seeking debt relief didn't increase, but it was still 3% higher than our national average. Check out our rates and book online with us at tulip apartelle loakan baguio.

In addition, it is important to know that, effective October of 2010, no up-front fees may be charged for debt relief. It’s crucial to note that Pennsylvania debt consolidation loans aren’t for everyone. Bankruptcy is generally considered to be the debt relief option of last resort.

Be careful about companies that make debt relief claims that may be false or unsubstantiated – debt relief can and has been able to help people get out of debt and save money – but debt relief does not make debts magically go away. The goal is, that you as the consumer can, hopefully, pay down your debts sooner than if you only continued to make the minimum payments at higher interest rates. Another important consideration is to understand how much you can potentially save, how long pennsylvania debt relief it will take for you to realize those savings, and the impact to your credit score. If you're struggling in debt, and looking to take the first step to becoming debt free, you've come to the right place because Pennsylvania Debt Relief has already served over 90,000 people from all walks of life. Once the account balance is equal to 25 percent of the total enrolled debt, National Debt Relief begins the negotiation process with creditors to reduce the total outstanding balance.

If the effective interest rate on your debt burden isn’t particularly high, one of these loans might not save you very much money. When minimum monthly payments are no longer affordable, it's time to ask for help from an expert. When you call an attorney you expect to get proper advice. It is the consumers responsibility to have the monthly funds available to pay down debts in a debt management program or to set aside sufficient funds so that a successful settlement can be reached with a creditor. Td makes banking more convenient with td bank online banking access to your accounts through.

See our profile at Lawyers.com or Martindale.com. Always research the debt relief service provider's BBB rating or debt industry credentials to ensure that you work with a solid company with a proven track record of helping individuals and families get out of debt. However, higher education comes at a cost, and many Pennsylvania residents have substantial amounts of student loan debt.

I have been through the gambit of emotions just like you are going through. Your debt relief analysis and savings projection is free. The bankruptcy attorney wanted me to schedule an appointment and come in to his office. By the time it’s all said and done, your Pennsylvania debt settlement plan could save you more than 40 percent on your outstanding debts. Despite its location in one of the most expensive regions of the country, the state’s median household income is nearly $1,000 lower than the national average.

Also called signature loans or personal loans. In the case of debt consolidation through a debt management plan (or DMP) – while not necessarily harmful to your credit score – the notation that you are enrolled in a program may appear on your credit report. A debt speitt should not be pushy, or try to pressure you in any way - and make sure. The price was staggering for someone who could not pay his bills.

View our articles about debt in Philadelphia and Pittsburgh for more information on debt in Pennsylvania. It may also allow you to lower your interest rates, which can help you get out of debt faster. Find pennsylvania debt relief lawfirm listings and reviews on lawyers com.

You explain your circumstances five or six times a day only to explain them again to someone different from the same company the very next day. Debt consolidation loans are regarded as a solid alternative to credit counseling. Regardless of your situation, if you're in debt – know that help is available to you – and we're ready to assist you.

See what debt relief can do for you and see how much you could save. Pennsylvania Debt Relief wants you to know that you can get out of debt, you can take control of your finances, and you can literally transform your financial future – but you must first see yourself achieving these dreams. We firmly believe bad things happen to good people all the time. Pennsylvania Debt Relief is proud to have already served over 90,000 people who are searching for information on debt relief and need a way to know free of charge – what debt relief could do for them – and what the potential savings could be.

Dealer Ships In Milwaukee That Let You Purchase A Car With Unemployment And Bad Credit

He rarely answered our questions, if he even bothered to return our calls at all. Debt settlement and debt consolidation programs that work with Pennsylvania residents are one way to get out of disabling debt in a shorter period of time, as well as, stop the harassing calls. With few exceptions, debt relief service providers, unless they are attorney based and meeting face to face with consumers, may no longer charge any up-front fees from a customer before debts have been successfully resolved or settled. Our occasional discussions always left us feeling berated and ignored. In other words, you’ll no longer have to worry about pennsylvania debt relief making a dozen or more debt payments each month. One contributing factor to this low statistic may be Pennsylvania’s educated work force.

ON The Job Training Jobs

TopConsumerReviews.com is a leading provider of independent reviews for thousands of products. It's also important to note that, many people in a debt consolidation program find that if they are able to stay on track and make their one consolidated payment each month and maintain on-time status month after month AND pay down their debts credit scores can actually improve.