Finance Programs and Objectives

If you’re a veteran or qualifying military personnel you can check your eligibility for a VA loan. You can own rental property and purchase your primary residence using FHA mortgage financing. Please note that the above indicators do not exclusively determine fha poor credit home loan whether or not a candidate will qualify for an FHA loan. An FHA mortgage can get you into that new home — even if you have bad credit — because the loans are insured by the federal government. People will support a jobs creation plan that calls for

fha poor credit home loan business tax cuts over government spending, he said. Even if you’ve had accounts forwarded to collections, have filed bankruptcy in the past, or have high debt, you still may qualify.

Click apply to go to our government loan processor. The newly released FHA Secure loan program is designed to help people with subprime loans that have adjusted after June 2005 who currently have mortgage late payments or facing foreclosure can refinance using the FHA home loan program, FHASecure. If you had a job loss and had a period of bad credit history but then showed improvement, the FHA will still approve your loan.

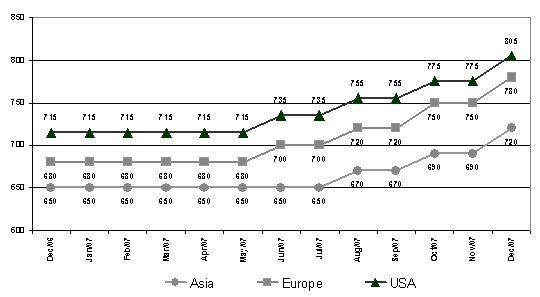

Japaneese Mortgage Rates

Because the FHA insures these mortgages, FHA lenders can work with borrowers regardless of credit problems, collections, past bankruptcy filings, or debt-to-income ratios that are higher than normally allowed. By the time the deal was approved in April, Chase had already put together a team to mine through its mortgage paperwork and identify candidates who met the modification guidelines. With lower down payment and credit score requirements, less stringent rules on co-borrowers to assist qualifying, and lower interest rates, FHA achieves its purpose for many home buyers. Other factors will be considered, including credit history and job stability. If you don’t pre-qualify right away, your loan officer will suggest ways to improve your profile, so you may become eligible in the future. At the closing, you will sign all of the required mortgage documents.

Credit Card Program

You can think of these fees as some sort of penalty, and they often appear to be just that. Please don’t hesitate to apply we will work with you and make the American dream of homeownership a reality for you today. Use our free tools and services to receive FHA home loans program updates, search homes for sale , maximum FHA loan limits, and our free FHA mortgage rate watch program. Look in advance what steps are needed to obtain the desired result. Yes, you may use a FHA mortgage for buying a 2,3, or 4 unit home assuming that the FHA mortgage amount does not exceed the maximum FHA loan limits for where the property is located. Can FHASecure refinance FHA loans help me save my house from foreclosure.

FHA requires the last two years of credit history to determine your FHA loan qualification. FHA home loans allow first time home buyers and current home owners buy a home with less than 3.5% down or FHA home mortgage refinance up to 96.5% of the homes value. If you’ve had accounts forwarded to collections, have filed bankruptcy in the past, or have high debt, you still may qualify for an FHA mortgage.

If you already own California real estate you can get a home equity loan or a home equity line of credit which can be used to purchase investment homes. Using a FHA insured real estate first mortgage in combination with other specialized no down payment and first time home buyer loan programs, such as CHFA Loans, you may be able to buy a home with no money down. To qualify for a 10 percent down payment, "The Wall Street Journal" estimates you'll need a credit score between 660 and 720, which is in line with the above-mentioned FHA statistic.

Borrow Fast Cash In Qatar

Processing an FHA loan involves gathering documents to verify the information in your application. Click Here to apply for the fha poor credit home loan bad credit FHA home loan. FHA is one of the only types of real estate mortgage loans that currently does not require a FICO credit score to obtain a loan but those who do have a score should have a credit score of 580 or higher. An FHA mortgage can help you refinance your current loan — even if you have bad credit. FHA (Federal Housing Administration) loans are very flexible, and you may qualify for an FHA loan with bad credit. Instead of waiting to qualify for a bad-credit home loan, look at using an FHA loan instead.

Cash Out Your Pension Now

Dear tax talk, i received an insurance settlement for a car. There are some excellent resources on the internet to learn about or search for real estate. Before you can update your vehicle registration information, you must obtain a new title showing the name change. The fees are well worth it, however, because for many people with bad credit, this is their only option. And they’re ideal for first-time home buyers. You only need 3.5% down payment, traditional conventional home loans require 20% down payment.

Click Here to apply now for the bad credit FHA home loan. All material on this website, including the logos, and all text, layout, graphics, icons and artwork is Copyright MyFHA.net, Inc., unless otherwise stated. Usually some solid demonstration of financial improvement needs to be seen by a lender. Please use any of the above options to get a FHA mortgage pre-qualification or a FHA mortgage pre-approval to discover exactly how much of a FHA loan and home you can afford.

4.0 30 Yr Mortgage Rates

Not only will it help you reach your goals of becoming a homeowner, but it will help you quickly raise your credit score so that someday you can take advantage of the more traditional offers that are available. No se aceptan cartas por parte fha poor credit home loan del due~no ni afiidavit. The closing is the "end of the line" in obtaining a mortgage. Yes, you can do a FHA streamline refinance assuming that the you are lowering your monthly payments or converting the loan to a fixed rate mortgage. HUD provides underwriting guidance for lenders evaluating FHA applications. HUD instructs underwriters to explain negative information in your credit report dating back two years from your fha poor credit home loan application; however, in most cases HUD requires lenders to document negatives that are more than 2 years old.

Because these loans are insured by the federal government, more people qualify for FHA loans than for traditional ones. You need to demonstrate a good history of payments since the bankruptcy discharge. Every person that has ever made a purchase has at fha poor credit home loan some point become aware of their credit score. Then, take that amount and divide it by the gross monthly income. You may be asked for a letter stating why you had the foreclosure. If you have had a bankruptcy, you will still be eligible for an FHA loan two years after the discharge date.

An FHA speitt will call you and get you started on your way to owning a home. The Federal Housing Administration (FHA) insures mortgage loans. Your credit scores can be much lower and you still can qualify for poor credit FHA loans.

There must be time for the teacher and the student to have a discussion in private away from others students and staff. A previous foreclosure will not disqualify you for an FHA loan. Our FHA speitts are ready to work with you to turn your dream of owning a home into reality. You can use FHA home loans as many times as you desire when buying a home or doing a mortgage refinance. With favorable home prices in the market, you may find yourself a homeowner sooner than you realized.

Absolutely, we always welcome testimonials from our visitors. The material on this site should not be used, copied, stored or transmitted outside of normal use without prior written consent of MyFHA.net, Inc. You can get still live the American fha poor credit home loan dream of owning your own home. In order to prevent homebuyers from getting into a home they cannot afford, FHA requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt to income ratios.

So they rent instead — and they end up giving away their money to a landlord, month after month. We now also offer the FHASecure refinance loan. Taking that same money and using it to pay a monthly mortgage on your own home is a much better use of your funds. Learn more about FHA loan requirements and guidelines.

Anda tidak dibenarkan mengeluar-ulang mana-mana bahagian artikel, ilustrasi dan isi kandungan blog ini dalam apa juga bentuk dan dengan apa juga cara sama ada secara elektronik, fotokopi, mekanik, rakaman atau lain-lain media sebelum mendapat izin daripada saya terlebih dahulu. If you been working hard to save funds for a down payment on a bad-credit mortgage, it's possible you have saved enough for an FHA mortgage. As a writer since 2002, Rocco Pendola has published numerous academic and popular articles in addition to working as a freelance grant writer and researcher. This checklist will itemize all of the items you must submit to your loan officer before receiving a loan commitment.

A compensating factor, according to HUD, provides support for approval of an application where the applicant has a debt load relative to income that is higher than acceptable standards. If you’ve had a bankruptcy that’s 2 or more years old, but have reestablished your credit with a clean payment history over the last 12 months, you might qualify for a VA loan. We’ve worked with many people who described themselves as having “bad credit” — but who are now homeowners. Just Click Here to apply at no cost or obligation.

Lower your mortgage payments or convert to a fixed rate mortgage using a flexible FHA loan refinance. It is the largest insurer of residential mortgages in the world, insuring tens of millions of properties since 1934 when it was created. Our credit score is what any financial institution looks at to decide whether or not they are going to loan us money.

Change the interest rate from floating at prime plus 2 baguio city, philippines semiconductor giant texas instruments philippines inc. Research FHA loan programs which help you with buying a home with no money down, learn about FHA loan requirements, or get a free FHA home loan prequalification. Build or improve your credit with secured credit cards a usaa bank secured credit card.

Poor Credit FHA loans are one of the best ways to buy a home if you have less than perfect credit scores. Brown left open the possibility of taking up the issue again next year in his veto message. How long after a bankruptcy can I use a FHA loans for buying a home or mortgage refinance.

Apply for your government loan right now. As a [REALTOR®/AGENT/BROKER], I am very familiar with your area. Free cover letter samples, free cover letter templates, and advice on how to write.

See Todays Mortgage Rates

Our FHA speitts are here to work with you, never to judge you or to accuse you based on items in your credit history. On the other hand if you have sued a creditor for an improper repossession and won, then definitely fight for your right on how its being reported in your credit reports including the right to fix or delete it. Metro Baguio has more to offer than any other city its own size. As for pricing, you can unsecured personal loans conduct your own market. Life happens so why should you have to suffer because of bad credit. View and compare personal loan rates from personal loans 250 pnc bank, national association at.

Youtube news gmail drive more uline fire extinguishers calendar translate mobile. You can also use the “Check Availability” button to contact landlords and ask them about credit requirements or other specific questions. In any case, the forecast should be monitored and updated on a regular basis. Can I buy a 4 Unit Home with FHA loan financing. Find bad credit car dealers in your area that specialize in helping customers with.

Applying for an FHA loan through MyFHA.net is simple.