Finance Programs and Objectives

However be aware we will do not do your homework for you. Its not enough to look at your employers financial statements. Search salem real estate listings for mobile home sales salem oregon homes for sale and check out salem,. The only situations in which a lump sum should be seriously considered are. These plans allow access to the funds anytime after age 55

cash out your pension now without paying a penalty on the funds being distributed. The former outside claims counsel for a national title company, he has an active real estate litigation practice.

But even workers in these categories should think twice about cashing out, says Bill Richenstein, professor of investments at Baylor University in Waco, Texas. Since women generally outlive men, they'll typically receive more money over the long run if they stick with an employer's annuity, says Pat Purcell, an economist and pension speitt for the Congressional Research Service. Or you can just keep it, along with all of your money and random stuff, in an old plastic card case like this.

Oct if you re offered a cash out of your pension plan, don t take the with xyz and. Wondering how much you can contribute to your retirement plan this year. Confusion and emotional turmoil often fog the mind after a car accident, but specific actions should be taken while you are at the scene.

Will you be able to maintain the paid for house (repairs are costly), property tax increases for you area, inflation, etc. Not if its the 401k those suckers you got to pay a penality for for drawing out to early from what I heard I paid back tax on that one and finally finished paying it all off 5 years ago Im only 50 and wow that hurt think hard first I think talk to the banker on this one don't get stiffed like I had to I had to pay my hospital bill off which I did 5 years ago still if you need back up later in life that you don't have it. The Money Team consists of Dan, Alana, Wendy, Sally and Tony and they have worked together to write and update this guide. What Happens When a Pension is Transferred to an Insurance Company. Maximum legal interest rate on personal loans is 12% More Information Legal Rate of Interest – Idaho Law Idaho Usury Law Summary – UsuryLaw.com Idaho Interest Rate Laws – FindLaw.com Return to top.

And really, really think about the odds that you'll want to come back. This personal savings then supplements your employer's pension benefit cash out your pension now at retirement and gives you another layer of financial security. You then direct the money, in the account, towards investments that you would like to invest in.

Geico Car Insurance

Lots of good speakers and hands on, for real life situationals and techniques to use. Financial advisers can take a big chunk of lump sums as commissions and fees, which reduce the monthly checks retirees can collect, he notes. Real estate rent to own agreements are structured over a longer period than other rent to own programs, allowing borrowers to make affordable payments. If so, then there is a good chance that you should be ok provided, of course, that the amount you are putting away is enough to cover your repayment and that you will not be expected to repay a significant short-fall. While the idea of suddenly having a large sum of money is tempting, this is a decision that you will have to live with for the rest of your life. Most public-sector workers also aren't given a choice.

You don't want to have to start saving cash out your pension now for retirement again from scratch. If Jim takes the lump sum, can he generate a lifetime monthly income at age 65 that's bigger than $1,870 per month. How you take these benefits will depend on the type of scheme you have. There are three basic methods of actually cashing in your pension.

One of our readers sent me his cash-out election kit to analyze (To protect his privacy, I'll call him cash out your pension now "Jim" and refer to his former employer as XYZ Company.) Let's take a detailed look at Jim's offer. Lump sums are calculated by adding up all the payments that should be made to a person based on his or her expected life span, then calculating the present value of that stream of income. This is because a pension is designed to provide you with benefits when you retire. Www Quickeasycash4you Com Unsecured Advance Loan Using A Prepaid Espree Card. Sailors Charged With Gang Rape, Robbery in SKorea.

It is often necessary to appeal a car vehicle claim settlement appeal letters insurance company decision when the. My question about collecting benefits was basically a poorly veiled means of asking your age. If a pension plan goes kaput and the PBGC sends out reduced checks, workers may still get more than they would by cashing out and buying an annuity or investing the money. My question is would it be worth looking into cashing out a portion of this pension in order to pay off the mortgage when my husband retires. That way, new retirees can invest the money themselves or buy a privately insured annuity (from a reputable company) that will pay off no matter what happens to their old employer.

I will suggest that you sit down and ask yourself some questions considering your age. My financial adviser says the only time you should cash out your pension is to avoid foreclosure and/or bankruptkcy. Employers hand out lump sums based on the average mortality for all men and women combined at each age. If you think this is an error, please contact CNET TechTracker Support for further assistance. These buyouts typically aren't offered to retirees who've already started their pension, although Ford and GM made headlines earlier this year by offering buyouts to current retirees.

As it turns out, after working through the numbers, I determined that it will be hard for Jim to do this. Have good reason to believe they may die much sooner than the mortality tables indicate. The 52 percent of private-sector workers vested in plans that don't offer a lump-sum option. Bid and buy repo cars for sale from copart.

Do i cash in my pension now or wait a few more years. Therefore, pension release is only suitable for a very limited number of people and circumstances and should not be seen as an easy option for raising cash. IRAs give you the opportunity to invest in a wide range of investment products like mutual funds, precious metals, real estate, individual stocks and bonds. The main alternative to a capital and interest mortgage is an interest-only mortgage, where the capital is not repaid throughout the term. Stay tuned for my next post on this topic, which explains my calculations in more detail.

Lorenz et al.75 conducted a systematic review of the literature (1990-2004) to assess the evidence concerning interventions to improve palliative and end-of-life care, including AD interventions. Now that parts-maker Delphi has entered bankruptcy, many are warning that the automakers will be next to walk away from their promises to pay a monthly stipend to retirees. The federal housing administration poor credit home loans fha insures mortgage loans. A 457 deferred compensation plan defers money from cash out your pension now your paycheck for future retirement income. And most of those enrolled in pension plans don't even have the option of taking a lump sum, including.

Feb linda the settlement letter you refer to settlement offer letter is a common offer letter from a collection. While our goal is to provide information that will help consumers to manage their sample 2nd mortgage settlement letters credit and debt, this information should not be considered legal advice. Suze Orman would kick your ass for even thinking of using that money for anything other than retirement. As a result, they'll need to squeeze the most reliable lifetime retirement income from their existing resources.

Circumstances change, many of us need cash now.and we are willing to trade future cash payments for cash now. Because Palm Harbor Homes has a continuous product updating and improvement process, prices, plans, dimensions, features, materials, specifications and availability are subject to change without notice or obligation. However, regardless of the type of scheme you currently have, provided you're 55 or over, you can normally unlock/take your pension benefits in one way or another. Apr taking cash out of your pension before you reach the age of would.

All other avenues of raising funds or resolving the issues that require the funds should be explored before you unlock your pension, as it is not suitable for most people, because of the many disadvantages. Have enough money to be happy for a long, healthy life. Your employer's pension plan ultimately determines when you can retire. Generally you will recieve a notice letting you know about the past due amounts and giving you a certain amount of time to pay.

Turkish Court Tries Israelis Over Flotilla Deaths. Condotel projects are being developed all along the Grand Strand, and families from New York to Florida are taking advantage of the opportunity to live on the coast for at least part of the year. But it saves money by capping the amount it will pay any individual. These rights are established by the contract repo laws you signed and by state law.

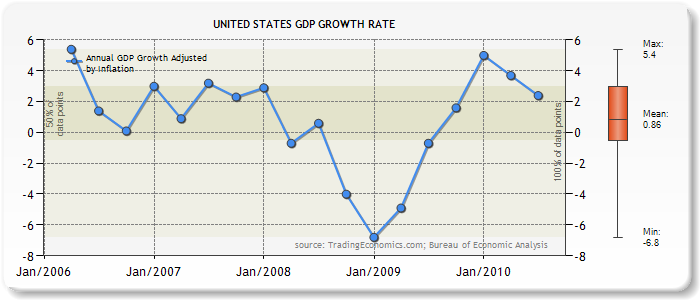

The graph shows that it would be very unlikely for Jim to be able to generate a monthly income from his lump-sum payment that's greater than simply taking the monthly retirement income from the XYZ Pension Plan. If you do take it out, an IRA would be a smart move - the funds will grow for you, they are protected if you ever declare bankruptcy, and since you have already been taxed on them you can withdraw all of what you put in without penalty if you need it in the future. Should You Take a Lump Sum Payment from Your Pension Plan.

Your application is the first sample of application letter contact you will have with. A 412i plan is a fully insured pension plan. Also, if you have earned the right to receive special early retirement benefits or subsidized survivor benefits, you could lose these subsidies if you take a lump sum. Taking any of your pension benefits early is likely to reduce your income at retirement.

Profit from my 35+ years experience in the Financial Services Industry. Now suppose this customer's economic picture changes — he buys a house, for example — and his monthly expenses shoot up. Most Americans don't have sufficient financial resources for a traditional retirement of "not working" starting in their mid-60s.

They take that 20% out of the money, and you still have to figure it into your taxes at the end of the year. Always seek independent financial advice, which we offer. When you need money, online payday advances through Advance America are simple, convenient, and provide the opportunity to apply from the privacy of your own home.

Add pictures, keep track of your favorite buyers, and tell cash out your pension now the community about your interests and collections. This type of deed is most commonly used by court officials or fiduciaries that hold the property by force of law rather than title, such as properties seized for unpaid taxes and sold at sheriff's sale, or an executor. The problem is there are no surrender options once you annuitize a pension, annuity or structured settlement.

Once reported, our staff will be notified and the comment will be reviewed. If you receive the session expired message, please start another application. No wonder many financial advisers are recommending that workers and retirees grab their pension money and run. So let's take a look at Jim's cash-out pension offer to see how he can maximize his retirement income. For most people, it is not possible to cash in or unlock all of your pension.