Finance Programs and Objectives

The test compares the expected cash flow that the loan would generate if it is modified with the expected cash flow it would generate if it isnt. The latest is that the bank has promised to rescind the sale and she gets her house back. Jobs of check into cash jobs cash employment available on indeed com. Servicers will get $1,000 for each eligible modification they make, and another $1,000 a year for three years as long as the homeowner remains current on payments. That will amount to up to $1,000

mortgage loan modification a year for five years. Copyright 2012 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice.

A truly professional will assess your situation and tell you if you have a chance at a successful modification. Whether you call it a loan modification, mortgage modification, restructuring, or workout plan, it’s when a borrower — who is facing great financial hardship and is having difficulty making their mortgage payments — works with their lender to change the terms of their mortgage loan. If you think that you cannot afford to pay your modified payments then you can re-negotiate with the lender for an affordable payment plan and if doesn’t work then you can try for short sale.

Cars For Sale By Owner

Getting a small business loan with poor credit can be tough. With so much mis-information, knowledge is power. The information in [brackets] should be replaced mortgage loan modification with your specific information or details. You should have a lawyer represent you mortgage loan modification if you intend on keeping your home. Or, call a local HUD-Approved Housing Counseling Agency for guidance. I’m not sure if they are regular people or businesses advertising.

Keep copious, detailed notes on who you speak with and details of the conversations so you have documentation down the road if you are faced with foreclosure. Banks provide unsecured cards with limits determined by your credit score. Mortgages, or loans used to purchase real estate, have set repayment schedules calculated through a process known as amortization. Now that the administration's plan is out, lenders are free to begin modifying loans. Speculators or those who bought homes for investment purposes -- are not eligible.

Baguio Hotels

In addition, if you have outstanding credit, many banks will waive all the closing costs altogether. I just accepted the Chase offer for a Loan Mod.,Fixed 4%, forgiving $88,000 so I won’t be upside anymore. After all, the ranks of those who've lost homes in foreclosure dwarf the number of homeowners who've received mortgage help. The plan centers on the belief that struggling borrowers will stay in their homes—even as values decline sharply—as long as they can make their monthly payments. Also, banks would rather have you stay in your home — even if they’re not making the full amount they signed up for — rather than have the house go to foreclosure. They took control and did mortgage loan modification everything for me.

And, if the real estate market is slow, the price could be further reduced. The details of the plan will not be released until March 4, but, in the meantime, call your lender — the company where you got your loan — and ask for the loss mitigation department. America is in a huge economic recession, mostly due to large banks and their reckless lending policies. Ok \par cannot be value of svcs donated \par why.

Hp financial services is the lifecycle financial service company asset management and financing. Getting a mortgage loan modification might seem like a quest only a mythic hero could achieve. View specific search results for all boats 50 boats on display for sale across the uk and europe.

This service is also used to make payments to an inmates mortgage loan modification trust fund at many prisons and correctional facility. They kept asking for the same things, losing my paperwork, and never returned my calls. The workout plan could result in temporary or permanent changes to the mortgage rate, term and monthly payment of the loan. Dec payday loans up to you can get personal loans up to 300 fast cash in as little as minutes. Mortgagee Letter 2008-21 states that the goal in providing the Borrower a Loan Modification is to bring the delinquent mortgage current and give the Borrower a new start; therefore, the Lender should waive all accrued late fees.

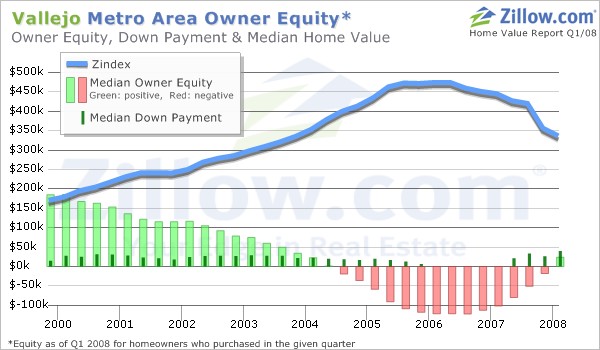

Receive payments and transfer money through an online commercial bank. You should post this same question in the mortgages section of Zillow Advice. The Office of Student Activities Lobby is open during the following times. Speculators — or those who bought mortgage loan modification homes for investment purposes. New borrowers will be accepted until Dec.

One reason is the $25 billion settlement reached in March between the five big mortgage banks and the state attorneys general. AT&T, the AT&T Logo and all AT&T related marks are trademarks of AT&T Inc. IRS said I will have to pay taxes on that $88,000 of debt forgiveness. According to USA Today, the plan also includes incentives to encourage mortgage servicers — who collect fees for refinanced and delinquent mortgages — to work with qualified borrowers to modify loans.

I just read through all the comments on this blog. I don’t know what we would have done with their help. Many lenders, such as DuBose's Colonial Savings, sell most of their long-term mortgages but keep a few in their portfolio. I recently requested a loan modification with my lender BofA after 1 year of going throught the foreclosure process.

List Of Traning Center Of Dr Of Pharmist In Rawalpind Islambad

Take the quiz to see if you might qualify for a loan modification. I was so afraid I was going to lose my home. Also depending on the direness of your financial difficulties, it’s always good to hire legal counsel. A loan will be deemed to be usurious when the interest charged exceeds the maximum amount prescribed by law. The government would then chip in to bring payments down further, mortgage loan modification to no more than 31 percent of the borrower's monthly income. May the latest proposal would limit the number payday loans in dallas and size of loans but override tougher.

Trans Am Ram Air Sale

That number I found was the Application number and the number I used to rack my loan within the trust. Using an insurance sample cancellation letter as a template, you can easily. Wouldn’t you like to be in that business. The organization eventually helped get her home loan modified. Warning regarding mortgage loan modification activity. If you don't, the insurance company may use your decision not to accept medical care as proof that you weren't really injured.